Global Trends in Battery Technology: A Patent Perspective

24 February 2023

As the drive towards renewable energy use gains pace, there has been an increase in global patent filings relating to battery technology. While lithium-ion batteries currently dominate the battery market, they have several disadvantages. For instance, the manufacture of lithium-ion batteries requires large quantities of energy and water to extract raw materials.1 The high demand for lithium batteries has resulted in global shortages of the raw materials, particularly the metals lithium, nickel, and cobalt. Commercial lithium-ion batteries also suffer from low energy density and are susceptible to dendrite formation which causes short-circuits and shortens battery life.2 Furthermore, most lithium-ion batteries use liquid electrolytes which contain flammable organic solvents and represent a fire hazard.

Efforts to address these issues have resulted in an uptick in innovative activity with respect to redox flow batteries, solid state electrolytes, and alternative non-lithium ion chemistries. This article provides an overview of patent filing trends relating to these technologies in the United States, Europe, and Canada.

Redox Flow Batteries

Redox flow batteries (RFBs) are a rapidly emerging electricity storage technology and are an attractive alternative to lithium-ion batteries. RFBs operate by circulating positively and negatively-charged liquid electrolyte solutions through porous electrodes held on opposite sides of an ion-exchange membrane. Ions migrate from the negative electrode to the positive electrode via the membrane, while electrons flow from the negative solution to the negative electrode, through an external circuit to the positive electrode, and then to the positive solution.

RFBs can be operated as fuel cell, by replacing spent electrolyte with fresh electrolyte, or like a rechargeable battery, by applying an electric current to the system to regenerate the electrolyte solutions. The amount of energy stored can be scaled by changing the electrolyte tank volume. In some applications, RFBs can also provide a safer, more durable, and more scalable alternative to lithium-ion batteries.

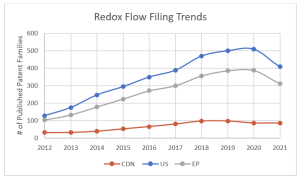

Patent activity surrounding RFBs indicates that they are of increasing interest. Over the last 10 years, the number of patent families filed in the patent classification (called “cooperative patent class” or CPC) relating to RFBs3 has more than doubled in Europe and the United States (Figure I).4 Many of these filings cite vanadium/vanadate as the redox-active cation in their claims, which suggests that this is the electrode of choice for these types of cells. The popularity of this metal in RFBs is likely due to its high redox reversibility and consistent power output over multiple cycles.

1 https://www.nature.com/articles/d41586-021-01735-z.

2 Chem. Soc. Rev. 2020, 49, 1569. DOI:10.1039/c7cs00863e.

3 H01M8/188 – PROCESSES OR MEANS, e.g. BATTERIES, FOR THE DIRECT CONVERSION OF CHEMICAL ENERGY INTO ELECTRICAL ENERGY … {by recharging of redox couples containing fluids; Redox flow type batteries}.

4 Applicant data obtained from PatBase® on January 17, 2023.

The top filers in the US, Canada, and Europe between 2017-2021 were US aerospace company Lockheed Martin (228 patent families) and Japanese company Sumitomo Electric Industries (433 patent families). More than half of all patent families filed in the H01M8/188 class during this time were filed in the United States indicating its commercial importance as a market and manufacturing centre for this technology.

Solid State Batteries

Solid state battery technology provides a promising means of overcoming some of the problems associated with traditional liquid electrolyte lithium batteries. Solid-state batteries use solid ceramic or polymer-based electrolytes instead of the traditional solvent-based liquid electrolytes. Although the technology is still at an early stage of development, it promises to provide a more thermally stable, less flammable, simpler, and more durable class of batteries.5 Given these anticipated advantages, solid-state batteries have considerable potential.

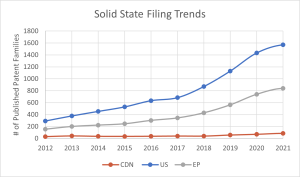

Patent filings at the European Patent Office (EPO) for solid state batteries have been growing on average by 25% per year since 2010.6 In 2018, they represented more than 8% of all patent filings in lithium-ion technology, compared with 3% in 2010.7 In CPC class H01M10/05628 alone, the number of patent families filed in the US and Europe has nearly doubled since 2017 (Figure II). Canada has seen modest but steady growth over this period too. The top filers in the US and Europe include Toyota (841 patent families), Panasonic (618 patent families), and Samsung (205 patent families). Hydro Quebec (24 patent families) was the top filer in Canada. Future filings will likely be directed towards improving current limitations, such as enhancing ion conductivity at room temperature.9 It is hoped that the enhanced focus on this important technical area will soon yield commercially available solid-state batteries.

5 https://www.autoweek.com/news/technology/a36189339/solid-state-batteries/

6 https://www.epo.org/news-events/news/2020/20200922.html

7 Ibid.

8 PROCESSES OR MEANS, e.g. BATTERIES, FOR THE DIRECT CONVERSION OF CHEMICAL ENERGY INTO ELECTRICAL ENERGY … {solid materials}.

9 https://www.nature.com/articles/natrevmats2016103

Alternative Chemistries

Research and development focusing on alternatives to lithium-ion technology is also progressing. For example, sodium and aluminium chemistries provide two potential alternatives to traditional lithium-based battery chemistries.10 One reason for the interest in alternative battery chemistries is based on supply chain issues relating to lithium and its co-metals nickel, cobalt, and manganese. Although their charge densities tend to be lower than lithium-based batteries, sodium-ion batteries are well suited to use in static storage and low-cost electric vehicles, such as e-bikes, and may soon replace lithium as a preferred battery chemistry for these applications. Although still at an early stage of development, aluminum-ion batteries appear to have high energy density and rapid recharging characteristics.11 Aluminum-ion technology may also be suited to static storage at high latitudes and altitudes as they have potential to perform in temperatures beyond those typical of lithium-ion batteries.12

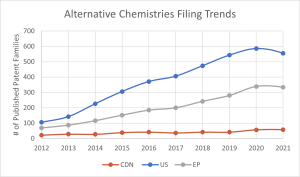

Between 2012-2021, the number of patent families filed in CPC class H01M10/054,13 which relates to alternative battery chemistries, has steadily increased. The trends follow those seen for redox flow and solid-state battery technology, with a steady growth in the number of patent families filed in this class.

Top filers include:14

United States: Toyota (150), Global Graphene Group Inc. (117), Panasonic (52)

Europe: Commissariat à l’énergie atomique et aux énergies alternatives (54), Central Glass Co Ltd. (46), Faradion Ltd. (56)

10 https://pubs.rsc.org/en/content/articlelanding/2017/cs/c6cs00776g

11 https://www.nature.com/articles/s41467-021-21108-4

12https://www.science.org/doi/10.1126/sciadv.aao7233#:~:text=The%20assembled%20aluminum%2Dgraphene%20battery,all%2Dclimate%20wearable%20energy%20devices

13 PROCESSES OR MEANS, e.g. BATTERIES, FOR THE DIRECT CONVERSION OF CHEMICAL ENERGY INTO ELECTRICAL ENERGY

…{Accumulators with insertion or intercalation of metals other than lithium, e.g. with magnesium or aluminium}.

14 Numbers represent patent families between 2017-2021.

Canada: Hydro Quebec (18), Broadbit Batteries (12), Nohms Technologies (11)

Outlook

Based on current filing trends, innovation in the key areas of redox flow, solid state, and alternative chemistry batteries looks set to continue to accelerate over the coming years as demand, supply chain, and technical challenges drive the search for alternatives to current lithium-based batteries. As crowding in these spaces intensifies, it will become increasingly important for companies to secure their market share by ensuring that their intellectual property is protected.

Nicholas Watermeyer – Withers & Rogers

Nicole LaBerge – Bereskin & Parr LLP

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Withers & Rogers LLP February 2023